Solar power offers a sustainable and cost-effective solution for homeowners looking to reduce their carbon footprint and lower their energy bills. However, the upfront costs of solar installation can be a barrier for many households. To address this challenge, various incentives and rebates are available at the federal, state, and local levels to encourage residential solar adoption. In this article, we will explore the different ways homeowners can maximize solar incentives to make the switch to solar energy more affordable and accessible. Additionally, we’ll discuss the importance of selecting the right solar power service provider in Texas and the benefits of solar battery installation.

Introduction to Solar Incentives

Solar incentives are financial incentives provided to homeowners and businesses to offset the cost of solar installation and encourage the adoption of solar energy. These incentives can take the form of tax credits, rebates, grants, and other financial incentives offered by governments, utilities, and other organizations. In Texas, where abundant sunshine makes solar energy an attractive option, understanding and maximizing solar incentives are essential steps in the transition to clean and renewable energy.

Federal Solar Incentives

At the federal level, one of the most significant incentives for residential solar adoption is the investment tax credit (ITC). The ITC allows homeowners to deduct a percentage of the cost of their solar installation from their federal taxes, effectively reducing the overall cost of going solar. As of 2024, the ITC provides a tax credit equal to 26% of the total cost of the solar system, including equipment and installation. However, the ITC is set to decrease to 22% by 2023 and will expire for residential installations after 2023, making now an opportune time for homeowners to take advantage of this incentive.

State-Level Solar Incentives

In addition to federal incentives, many states offer their incentives to further incentivize residential solar adoption. In Texas, several state-level incentives are available to homeowners, including rebates and performance-based incentives offered by utilities and solar industry organizations. These incentives vary depending on the region and utility provider but can significantly reduce the cost of solar installation and improve the financial viability of solar energy for homeowners.

Local Solar Programs

Local governments and utilities also play a crucial role in promoting residential solar adoption through various programs and initiatives. Municipalities and utility companies may offer additional rebates, incentives, or financing options to encourage homeowners to go solar. These programs may include solar leasing programs, community solar projects, or streamlined permitting processes to make solar installation more accessible and affordable for residents.

Financing Options

For homeowners unable to afford the upfront cost of solar installation, financing options such as solar loans and leases can provide an alternative means of financing. Solar loans allow homeowners to finance the cost of solar installation through a loan, with the option to pay it back over time through monthly payments. Solar leases, on the other hand, allow homeowners to lease solar equipment from a third-party provider in exchange for fixed monthly payments. These financing options can help homeowners overcome the initial cost barrier and start saving money on their energy bills from day one.

Maximizing Solar Incentives

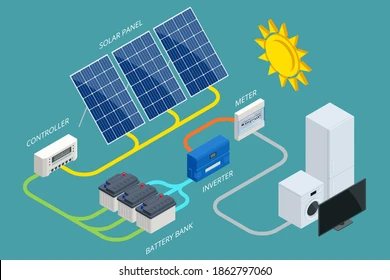

To maximize solar incentives, homeowners should take a proactive approach to research and planning. This includes understanding the eligibility requirements and application process for federal, state, and local incentives, as well as exploring financing options and selecting the right solar power service provider. When choosing a solar provider in Texas, homeowners should look for reputable companies with a track record of quality installations and excellent customer service. Additionally, homeowners should consider investing in solar battery installation to maximize energy savings and incentives, allowing them to store excess energy generated by their solar panels for use during peak demand periods or power outages.

Case Studies

Real-life examples of homeowners who have successfully maximized solar incentives can provide valuable insights and inspiration for others considering solar adoption. By sharing stories of homeowners who have reduced their energy bills, increased their energy independence, and contributed to a cleaner environment through solar energy, we can demonstrate the tangible benefits of going solar and motivate others to take action.

Challenges and Solutions

Despite the numerous benefits of solar incentives, several challenges may hinder residential solar adoption, including upfront costs, complex incentive programs, and regulatory barriers. However, with proactive planning, community engagement, and policy advocacy, these challenges can be overcome. By raising awareness of available incentives, streamlining application processes, and advocating for supportive policies, we can make solar energy more accessible and affordable for all homeowners.

Future Outlook

Looking ahead, the future of solar incentives for residential solar adoption looks promising. As technology continues to improve and costs continue to decline, solar energy will become even more affordable and accessible for homeowners across the country. Moreover, as the urgency of addressing climate change becomes increasingly apparent, governments and utilities are likely to expand and enhance solar incentive programs to accelerate the transition to clean and renewable energy.

Conclusion

In conclusion, maximizing solar incentives is essential for promoting residential solar adoption and accelerating the transition to clean and renewable energy. By taking advantage of federal, state, and local incentives, homeowners can significantly reduce the cost of solar installation and enjoy long-term savings on their energy bills. Additionally, by selecting the right solar power service provider and investing in solar battery installation, homeowners can maximize energy savings and incentives while increasing their energy independence and resilience.

FAQs

- Are solar incentives available to homeowners in all states?Solar incentives vary by state and utility provider, so it’s essential to research available incentives in your area.

- How much can I save by installing solar panels with incentives?The amount you can save depends on various factors, including the size of your solar system, your energy consumption, and the available incentives in your area.

- What is the payback period for a residential solar installation?The payback period for a residential solar installation depends on factors such as the cost of the system, available incentives, and energy savings. On average, homeowners can expect to recoup their investment within 5 to 10 years.

- Can I still qualify for solar incentives if I lease my solar panels?In most cases, homeowners who lease solar panels are not eligible for federal tax incentives. However, they may still qualify for state and local incentives depending on the terms of the lease agreement.

- How can I find out more about available solar incentives in my area?To learn more about available solar incentives in your area, you can contact your local utility provider, consult with a solar installer, or visit government websites that provide information on renewable energy incentives and programs.